Embarking on the journey of investing in cryptoassets can be both exhilarating and daunting. {Bitcoin, the pioneering copyright|, a revolutionary digital asset, stands as a beacon of innovation and potential within this dynamic landscape. To navigate this complex world effectively, aspiring investors must equip themselves with a robust understanding of Bitcoin's fundamentals, market dynamics, and inherent challenges. This comprehensive guide serves as your compass, illuminating the path to informed decision-making in the realm of Bitcoin investment.

- Internalize the underlying technology that powers Bitcoin, delving into its decentralized nature and cryptographic security.

- Assess Bitcoin's historical performance, identifying key trends and patterns to inform your investment strategy.

- Uncover a range of investment approaches, from holding Bitcoin long-term to engaging in short-term trading.

- Mitigate risk by diversifying your portfolio and implementing sound risk management practices.

Stay informed about the latest developments in the Bitcoin ecosystem, including regulatory updates and technological advancements. With a comprehensive grasp of these essential aspects, you can confidently venture on your Bitcoin investment journey, maximizing your potential for success.

Deciphering Bitcoin's Market Volatility for Investors

Navigating the dynamic landscape of Bitcoin investing requires a keen understanding of its inherent price swings. Traders consistently grapple with the challenge of anticipating these sharp price movements, often influenced by a confluence of factors. Technical analysis tools provide valuable clues, but ultimately, success hinges on calculated decisions. A prudent investor acknowledges the inherent risks associated with Bitcoin while seeking sustainable returns.

The complex nature of Bitcoin's market environment necessitates a comprehensive approach to investment strategy.

Bolster Your Portfolio with Bitcoin

In the dynamic landscape of finance, traders are constantly exploring novel avenues to maximize returns and mitigate risk. Bitcoin, the groundbreaking digital asset, has emerged as a compelling asset for portfolio rebalancing. As an distinct asset class, Bitcoin's fluctuations often diverge from traditional investments, providing a potential hedge against corrections in more established holdings. By strategically integrating Bitcoin into their portfolios, traders can potentially stabilize the overall volatility and achieve a more robust balance.

Embarking into the copyright Landscape: A Beginner's Guide to Bitcoin Investing

The world of copyright can seem complex, especially for rookies. However, with suitable understanding, even the most unfamiliar investor can explore into this dynamic market. Bitcoin, as the foremost copyright, offers a intriguing entry point for those desiring to expand their assets.

- First and foremost, it's vital to learn yourself about the principles of Bitcoin and blockchain technology.

- Next, choose a reputable copyright market.

- Finally, start with a modest investment that you are comfortable to lose.

Keep in mind that copyright investing involves substantial risks. Thus, it's wise to participate responsibly.

Delving into Bitcoin's Worth: Financial Opportunities and Risks

Bitcoin has emerged as a groundbreaking force in the financial landscape, capturing the imagination of investors worldwide. Understanding its core value proposition is vital for navigating the nuances of this uncharted asset class.

On one hand, Bitcoin presents promising investment potential. Its self-governing read more nature, limited supply, and growing adoption have fueled speculation and the potential for significant gains.

However|Conversely|, Bitcoin is a volatile asset, susceptible to extreme fluctuations. Its value can plummet dramatically in short periods, posing inherent threats to investors.

Furthermore, the regulatory landscape surrounding Bitcoin remains fluid, creating uncertainty and potential for future changes. Before venturing into Bitcoin {investments|, consider the positive outcomes| carefully alongside the associated dangers.

The Future of Finance: Bitcoin as a Long-Term Investment Strategy Strategy

As the global financial landscape undergoes rapid transformation, innovative assets like Bitcoin are emerging toward disrupt conventional investment paradigms. Proponents for Bitcoin declare that its decentralized nature and finite supply offer a compelling long-term investment. While volatility continues a significant factor, many traders view Bitcoin towards a store of value comparable to digital gold.

- Additionally, the growing acceptance of Bitcoin by institutions and individuals propels its long-term value.

Eventually, the future of finance involves a diverse range to assets, with Bitcoin poised to play a significant role.

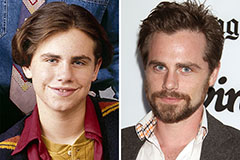

Rider Strong Then & Now!

Rider Strong Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!